Hotcoin Research | The “Invisible Hand” Behind Market Liquidity: The Role, Landscape, and Future of Crypto Market Makers

I. Introduction

The October 11 market crash offered a clear lesson: prices don’t collapse from a single sell order, but from a liquidity vacuum. When several market makers halted operations to limit exposure, traders lost their counterparties. Combined with cascading liquidations and deleveraging, prices plunged — amplifying volatility and slippage into a waterfall-style crash.

In crypto markets, prices aren’t formed purely by natural matching of buy and sell orders. They rely on continuous quoting and depth provision from market makers. These players act not just as lubricants of trading, but as the central nervous system of price discovery. Once this “invisible hand” withdraws, the market loses its balance.

This paper explores how market makers stabilize price discovery, why they disappear during stress events, and how their retreat reshapes market dynamics. It also breaks down their role, profit model, and strategies, reviews seven leading market makers and their representative tokens, and examines the trust-rebuilding process shaping the future order of crypto liquidity.

II. Understanding the Functions and Roles of Market Makers

Market makers serve as both price stabilizers and risk buffers within the system. When they operate efficiently, markets remain stable, liquid, and have low slippage — but when they withdraw or fail, the entire structure can quickly lose balance.

1. Functions and Roles of Market Makers

Market makers (MMs) are the “invisible hand” of the crypto market, performing several essential functions that sustain liquidity and stability:

- Continuous Quoting and Depth Maintenance

In CEX order books, DEX RFQ systems, and AMM pools, MMs continuously post bid/ask quotes, dynamically adjusting spreads and order sizes based on volume and risk limits. They maintain 1–2% market depth and rapid refill speed, minimizing slippage and impact costs — including AMM rebalancing and concentrated liquidity management. - Price Discovery and Cross-Market Linkage

Through cross-exchange, cross-chain, spot–futures, and stablecoin/pegged-asset arbitrage, MMs swiftly align dispersed prices. By connecting ETF, ETP, and RFQ networks, they synchronize on-chain/off-chain and primary/secondary markets, narrowing basis spreads. - Inventory Management and Risk Hedging

MMs absorb short-term buy/sell imbalances, consolidating fragmented orders into net positions. They hedge exposure via perpetuals, futures, options, or borrowing tools, keeping funding rates and basis spreads within normal ranges. - Token Launch and Cold-Start Liquidity

During TGE or initial listing phases, MMs provide baseline liquidity through token loans, collateralized inventory, or rebate agreements, stabilizing early volatility. They execute large institutional or whale orders, reducing both visible spreads and hidden impact costs — helping assets reach a tradable state faster.

Hence, market makers sit between public utility and competitive enterprise. They enhance market efficiency through capital, algorithms, and expertise — benefiting all traders. Yet, when incentives misalign or risk controls fail, these stabilizers can quickly become volatility amplifiers.

2. Main Types of Market Makers

Market makers differ in scale, strategy, and positioning, each playing a distinct role in shaping crypto market liquidity. The three main categories are:

- Professional Market Makers

Armed with advanced algorithms and high-speed execution, these firms fill order books, narrow spreads, and enhance trade execution quality. Backed by significant capital and automation, they operate across CEXs, DEXs, OTC desks, and ETF/ETP products, quoting continuously for major assets such as BTC, ETH, and SOL, while hedging positions across multiple venues. - Advisory or Project Market Makers

Engaged through liquidity support agreements with project teams, they provide token lending, early-stage orders, and rebate incentives to maintain baseline liquidity after listing. Though smaller in scale, they play a crucial role in new token launches and long-tail assets, often working under structured terms that include minimum depth guarantees or rebate clauses. - Algorithmic or AMM Liquidity Providers

This group includes automated LPs, quote bots, and small-scale market-making entities operating in AMM models. With limited capital and hedging capacity, they support fragmented on-chain liquidity across smaller tokens or chains. However, they are more vulnerable to extreme volatility and tend to withdraw liquidity during market stress.

3. Market-Making Mechanisms and Profit Models

Contrary to popular belief, market makers are not “dealers” manipulating prices, but rather high-frequency fee engines that profit from small, steady spreads across massive volumes.

- Spread Capture

This is the core of market-making. By continuously quoting bid/ask prices, MMs earn the difference when trades execute between the two. For example, quoting BTC at $64,000 (bid) / $64,010 (ask) yields a $10 profit per trade. While each spread is minimal, the cumulative return across billions of trades per year becomes substantial. - Fee Rebates and Incentives

Most exchanges follow a maker-taker model — makers enjoy lower or even negative fees, while takers pay higher ones. With high volumes and automation, MMs capture positive rebates. Exchanges and project teams also provide extra rewards such as token bonuses, liquidity subsidies, or rebate programs to attract liquidity providers. - Hedging and Basis Trading

To stay market-neutral, MMs hedge inventory risk using perpetuals, futures, or options. For instance, holding excess ETH spot, they might short ETH futures to lock in exposure. They also arbitrage basis gaps between spot and futures markets, earning near risk-free returns. - Statistical and Structural Arbitrage

Beyond spreads, MMs capitalize on microstructure inefficiencies, including: - Calendar spreads: price differences across contract maturities

- Cross-asset arbitrage: between correlated tokens (e.g., stETH–ETH)

- Volatility arbitrage: between implied and realized volatility

- Funding rate arbitrage: capturing cost differentials across venues

Together, these methods form a profit matrix built on scale, speed, and risk control rather than speculation.

In a market exceeding $10 billion in daily volume, even an average spread of 0.02% supports a vast profit ecosystem.

III. Overview of Major Market Makers

Market makers transform crypto markets from disorderly quoting into sustainable execution systems.

Today’s leading players include Jump Trading, Wintermute, B2C2, GSR, DWF Labs, Amber Group, and Flow Traders.

This section reviews their backgrounds, strategies, scale, and representative token portfolios to illustrate how professional liquidity provision shapes market structure and efficiency.

1. Jump Trading

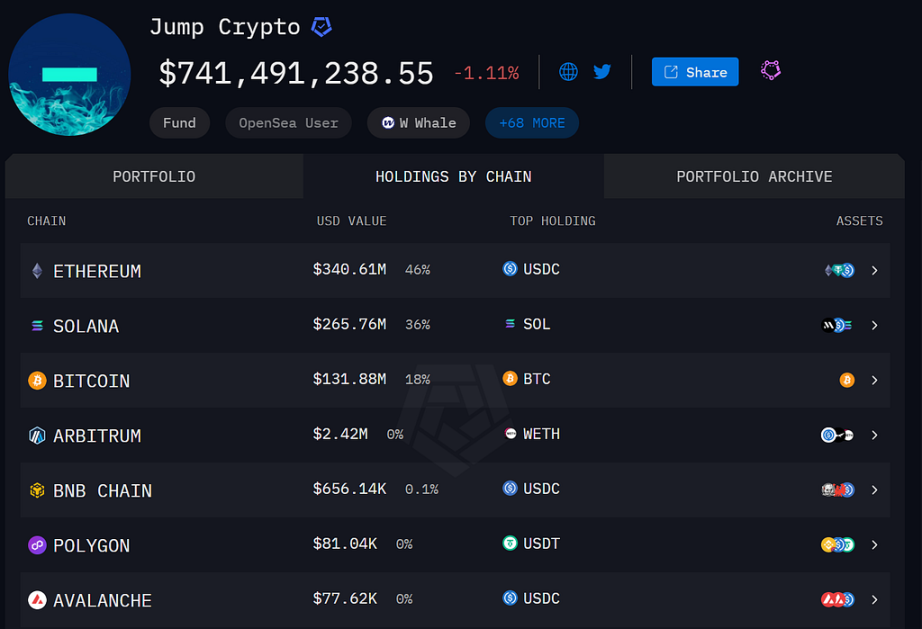

Source: Arkham Intelligence

Profile

Originating from traditional high-frequency quantitative trading, Jump Trading is active not only in market making but also in infrastructure investment and blockchain research. As of October 23, 2025 (Arkham data), the firm’s on-chain holdings total approximately $740 million.

Market-Making Style

Jump’s portfolio leans toward fund management and medium-to-low beta positions, with a significant share in stablecoins and staking derivatives. During periods of high volatility, it dynamically adjusts staking/re-staking allocations and executes large-scale redemptions or swaps to control exposure.

Representative Holdings

- Top 5 Assets: SOL, BTC, USDC, USDT, ETH

- Hot Positions: USD1, WLFI, W, SHIB, JUP

2. Wintermute

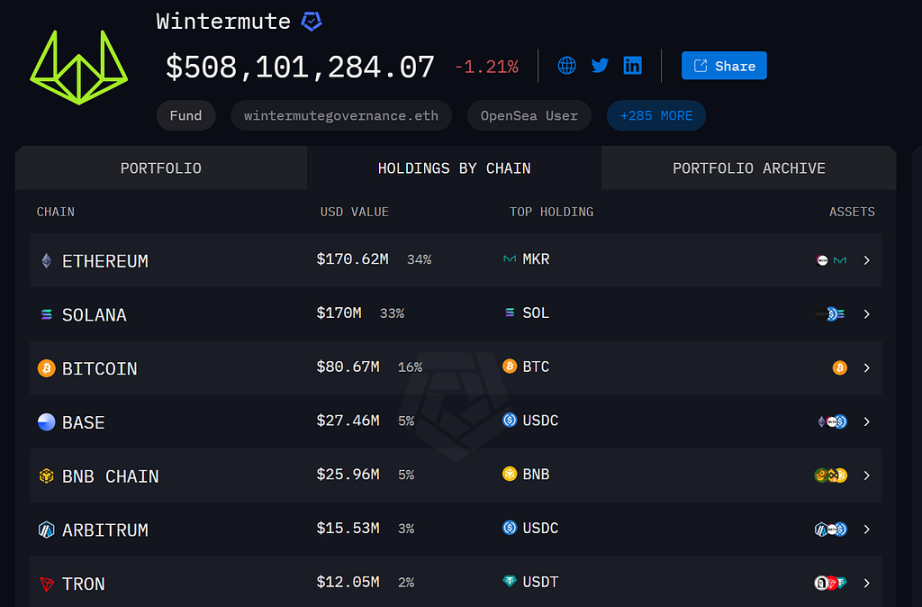

Source: Arkham Intelligence

Profile

A veteran quantitative market maker active across both centralized and decentralized venues. Beyond mainstream assets, Wintermute has been highly active in the new-token and meme-token sectors over the past two years, providing liquidity for multiple project launches. As of October 23, 2025, its total on-chain holdings are approximately $500 million.

Market-Making Style

Wintermute employs a cross-market, cross-asset strategy that integrates event-driven (new tokens/TGEs), high-frequency, and grid-based trading approaches. It often receives allocations or token loans during early-stage token launches to support two-sided quoting and is publicly recognized as one of the official market makers for Ethena (ENA).

Representative Holdings

- Top 5 Assets: SOL, BTC, USDC, MKR, rSTETH

- Hot Positions: LINK, ENA, PENGU, FARTCOIN, Binance Life

3. B2C2

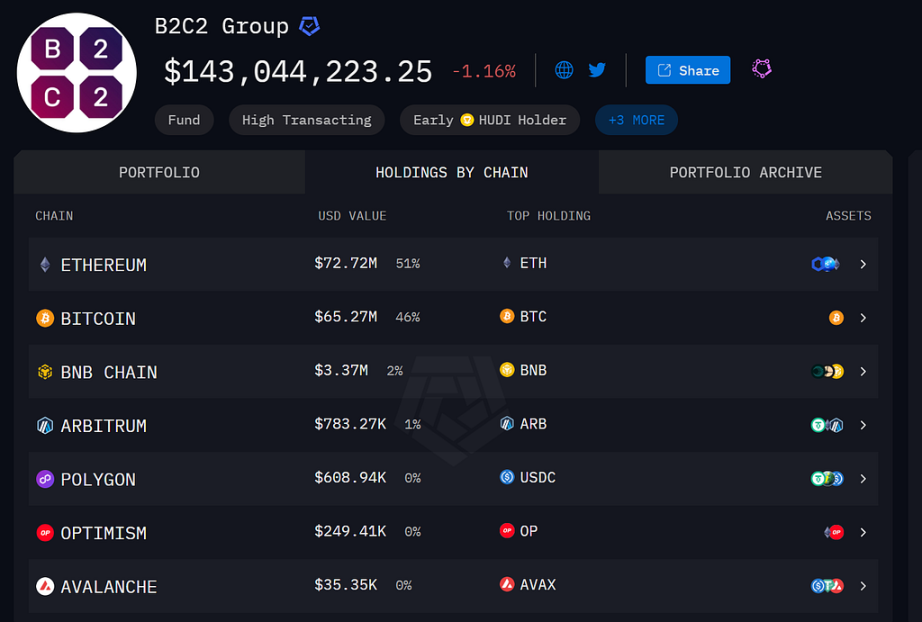

Source: Arkham Intelligence

Profile

One of the earliest institutional OTC and market-making providers, B2C2 is wholly owned by Japan’s SBI Group and maintains deep collaborations with major exchanges and regulated venues. As of October 23, 2025, its visible on-chain holdings total approximately $140 million.

Market-Making Style

B2C2 operates under an “institutional prime brokerage + outsourced liquidity” model, offering stable coverage for both blue-chip and liquid long-tail assets. Its public reports frequently disclose trading volumes and directional flows by asset category, reflecting its transparent and data-driven approach.

Representative Holdings

- Top 5 Assets: BTC, ETH, RLUSD, LINK, AAVE

- Hot Positions: LINK, BNB, UNI, FDUSD, ASTER

4. GSR Markets

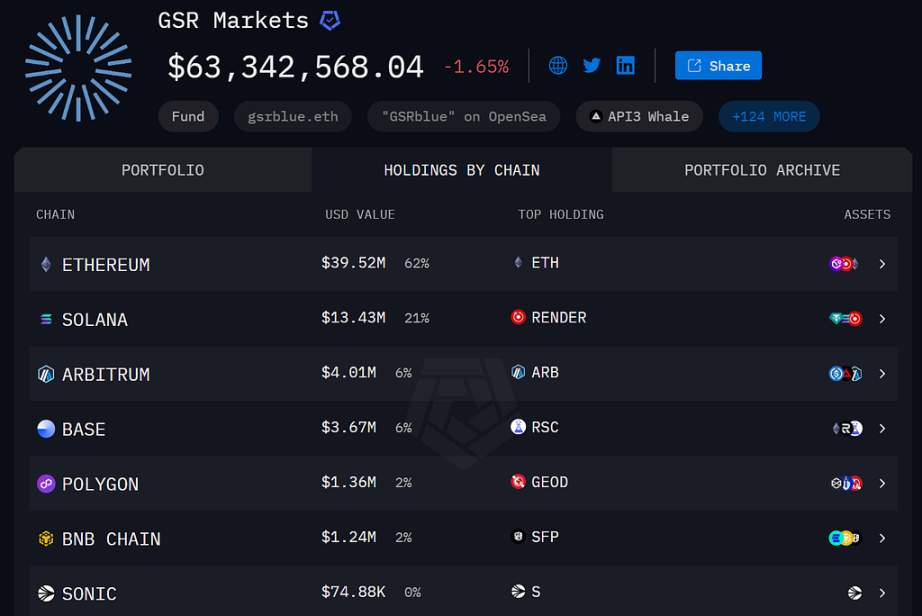

Source: Arkham Intelligence

Profile

Founded in 2013, GSR is one of the oldest professional crypto market makers, known for its strong regulatory credentials, including licensing in Singapore. As of October 23, 2025, its visible on-chain holdings total around $60 million.

Market-Making Style

GSR operates as an institutional, full-stack trading firm, combining market making, structured products, and algorithmic execution. It frequently serves as the official market maker for projects during TGE and circulation phases, supporting both liquidity and price stability.

Representative Holdings

- Top 5 Assets: ETH, RNDR, ARB, SOL, SXT

- Hot Positions: AAVE, FET, RSC, SKY, SHIB

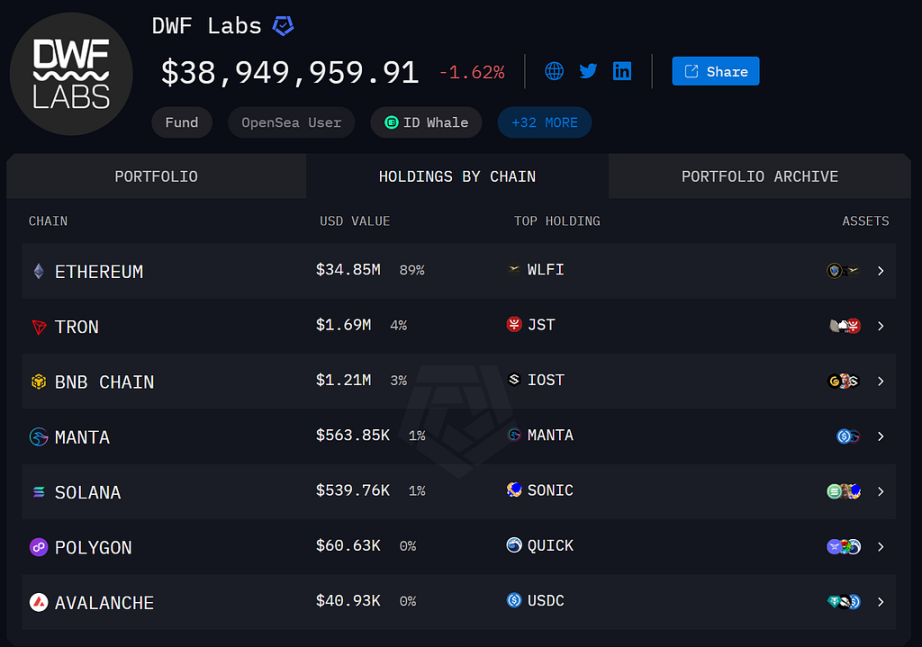

5. DWF Labs

Source: Arkham Intelligence

Profile

Operating under a dual-engine model of “Investment + Market Making”, DWF Labs is known for its frequent participation across ecosystems and broad token coverage. As of October 23, 2025, its visible on-chain holdings total approximately $40 million.

Market-Making Style

DWF Labs combines early-stage (cold-start) liquidity provision with secondary-market making, leveraging multi-exchange and cross-chain exposure to enhance price efficiency and maintain inventory balance. Its portfolio strategy blends beta exposure with long-tail assets, positioning it as both an investor and liquidity stabilizer.

Representative Holdings

- Top 5 Assets: WLFI, JST, FXS, YGG, GALA

- Hot Positions: SONIC, JST, PEPE, SIREN, AUCTION

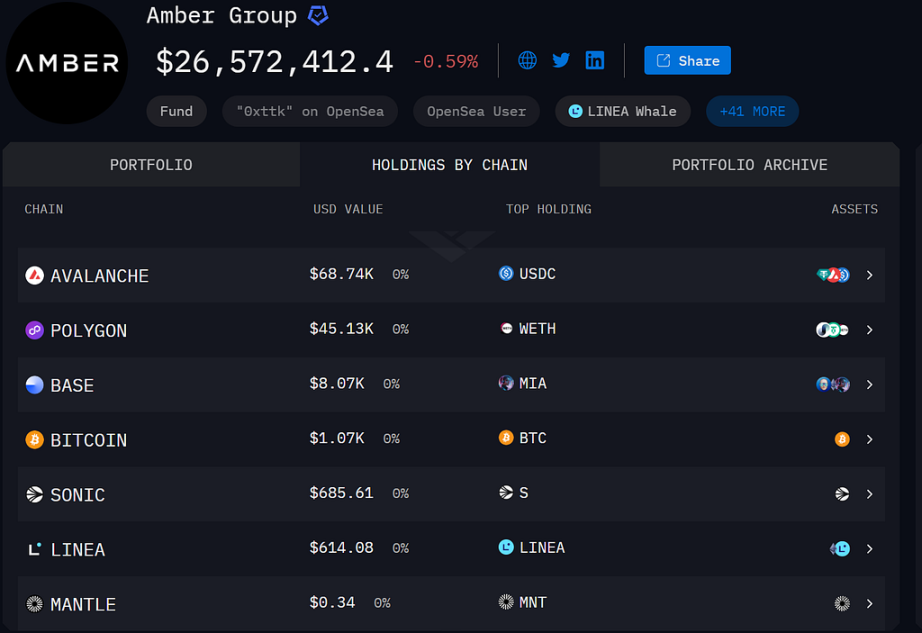

6. Amber Group

Source: Arkham Intelligence

Profile

An Asia-based, globally active full-stack trading and liquidity provider, Amber Group combines market making, derivatives, custody, and infrastructure services under one integrated framework. As of October 23, 2025, its visible on-chain holdings total approximately $26 million.

Market-Making Style

Amber focuses on institutional market making and token cold-start liquidity, supported by research-driven and event-driven strategies. During TGE or initial listing phases, it frequently utilizes token borrowing or allocation quotas to stabilize order books and market depth.

Representative Holdings

- Top 5 Assets: USDC, USDT, G, ETH, ENA

- Hot Positions: G, ENA, MNT, LINEA, YB

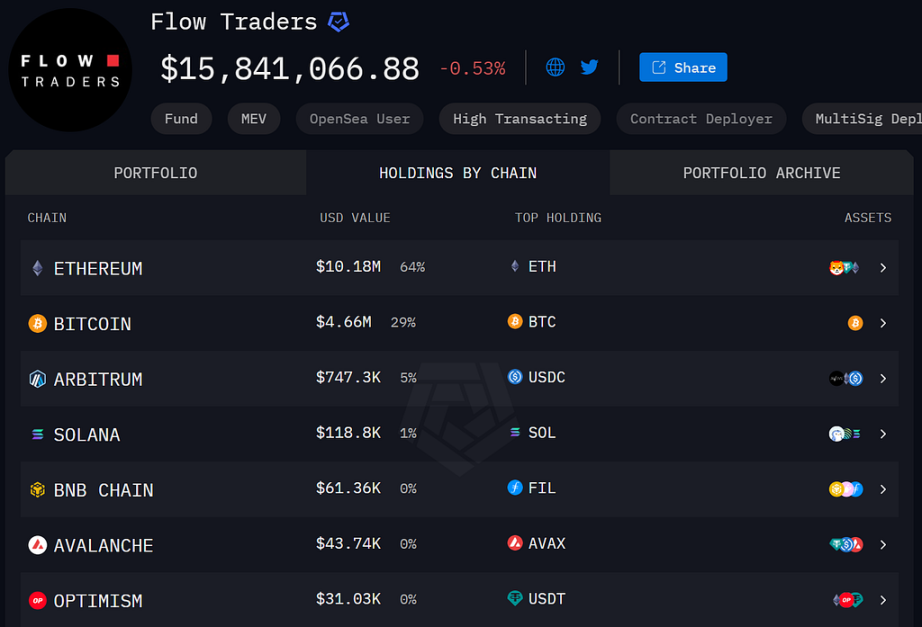

7. Flow Traders

Source: Arkham Intelligence

Profile

A Europe-based global leader in ETP/ETF market making, Flow Traders entered the crypto sector in 2017 and has since become a core liquidity and risk-hedging provider for crypto exchange-traded products. As of October 23, 2025, its visible on-chain holdings total approximately $15 million.

Market-Making Style

Flow Traders operates through ETP hubs, offering continuous quotes and creation/redemption services for secondary-market investors. It currently covers 200+ crypto ETPs, with underlying exposure to more than 300 tokens.

Representative Holdings

- Top 5 Assets: ETH, BTC, USDT, USDC, SOL

- Hot Positions: FIL, AVAX, SHIB, WLFI, DYDX

Together, these seven market makers manage over $1.5 billion in visible on-chain assets, playing pivotal roles in liquidity depth, price discovery, and risk absorption across both centralized exchanges and on-chain protocols. From high-frequency quant firms to institutional liquidity houses, and from new-token launches to ETF hedging, these firms collectively form the core backbone of global crypto liquidity.

IV. Controversies and Conflicts Faced by Market Makers

Due to information asymmetry, misaligned incentives, and opaque contract terms, market making can easily shift from a public good into a private-interest game.

Key conflicts faced by market makers include price manipulation vs. liquidity provision, rational risk control vs. market volatility, and public-good intent vs. profit-driven behavior.

1.Price Manipulation vs. Liquidity Provision

In the early days of crypto, market makers often played a three-in-one role — liquidity providers, investors, and advisors. Such overlapping roles created inherent conflicts of interest. A market maker is expected to maintain liquidity and stabilize prices, yet it may hold or be allocated a large token supply, creating incentives to drive prices up and sell for profit.

The Movement Labs case illustrates this tension: around 66 million MOVE tokens (about 5% of circulating supply) were transferred to a designated market maker, with a clause allowing sales once market capitalization reached a threshold. Within a day of listing, the entity reportedly sold the entire allocation, earning $38 million.

This demonstrates how a market maker can act simultaneously as a liquidity provider and price manipulator. Any non-transparent arrangement risks being perceived as “grey-zone trading”, eroding overall market trust.

2.Rational Risk Control vs. Market Volatility

Market makers profit from spreads, rebates, and hedging returns, but their risk exposure increases sharply during volatility spikes. Rational profit motives drive them to protect capital rather than defend depth. During extreme conditions, market makers may collectively withdraw liquidity, worsening price collapses.

The October 10–11, 2025 crash exemplifies this: when macro risks emerged, multiple firms’ risk models (covering exposure limits, VaR thresholds, and liquidity stress tests) were triggered simultaneously. As a result, they reduced or suspended quoting across venues.

While rational from a risk-control standpoint, the systemic effect was severe — liquidity evaporated, leaving only sell orders and minimal buy-side depth. Thin order books amplified slippage, causing cascading liquidations and deeper declines. Each wave of forced selling triggered new risk limits, forming a negative feedback loop. Ultimately, the crash wasn’t caused by excessive selling, but by the absence of buyers.

3.Business Expansion vs. Depth Maintenance

As token counts surge and market narratives shorten, market makers face structural challenges. Traditional high-frequency models optimized for BTC and ETH now struggle in a multi-chain, multi-asset, fragmented ecosystem. Leading firms possess algorithmic and capital advantages, but scaling these systems to thousands of assets is complex. The key question has shifted from “Can we make money?” to “How can we scale without sacrificing market depth?”

Market making depends on capital, computation, and data — all scarce during rapid expansion. To scale, firms must pursue automation and strategy reuse through unified engines, cross-chain routing, and AI-based optimization. Yet scaling introduces new risks: delayed strategy migration, depth distortion, and heightened volatility in illiquid or long-tail assets.

4.Public Good vs. Profit-Driven Conflict

Market making uses private capital to provide public liquidity, reducing friction and improving price discovery for all participants — while risk is concentrated among a few institutions.

In practice, contracts often include token loans, rebates, and exit thresholds, with KPIs tied to price performance rather than sustainable liquidity. This can incentivize short-term price-pumping behaviors — push the price up, then sell down.

Without sufficient disclosure or oversight, market making can deviate from its intended purpose, devolving into selective or opportunistic liquidity. Ultimately, a market maker can be both a stabilizer and a fault line in crypto liquidity provision.

V. The Road Ahead: From “Invisible Depth” to “Institutionalized Liquidity”

The true fragility of the crypto market lies not in volatility or capital scale, but in the uncertainty of who provides liquidity — and when they might withdraw it. As token supply explodes and narratives shift faster than ever, market makers are being forced to evolve: from small teams serving a handful of mainstream assets to distributed liquidity networks covering thousands of tokens, cross-chain assets, and stablecoins.

The challenge ahead is not only how to do more, but how to do it more stably, transparently, and compliantly.

1. Information Symmetry and Transparency

Transparency is the foundation of a healthy market-making ecosystem. Partnerships between projects and market makers must move beyond vague “liquidity support” claims toward institutionalized disclosure standards:

- Publicly disclose core contract terms — including notional amounts, token loan sizes, rebate ratios, and exit conditions.

- Publish the list and whitelisted addresses of active market makers, allowing verification of genuine order sources.

- Regularly release depth metrics, spread data, and performance indicators (e.g., order response time, cancellation rate, fill ratio).

Exchanges should integrate market-maker monitoring into their surveillance systems, flagging abnormal spreads, concentrated positions, or suspicious cancel patterns. If ghost orders, self-trades, or wash trading among linked accounts are detected, exchanges must have the authority to suspend or downgrade the offending maker.

In the future, blockchain explorers and analytics platforms could standardize these metrics into “Liquidity Quality Scores.” When traders can clearly identify which firms provide the most stable and responsive liquidity, market making will evolve from a black box into a competitive, auditable service industry.

2. Circuit Breakers and Recovery Mechanisms

During extreme volatility, it is rational for market makers to withdraw — but markets need system-level shock absorbers to prevent liquidity vacuums. A robust framework of circuit breakers and liquidity recovery systems is essential to institutionalize the crypto market structure.

When primary market makers trigger risk-off exits, exchanges or protocols should automatically activate a backup market-maker pool — a pre-registered rotation of secondary makers maintaining baseline depth. In parallel, matching engines could deploy algorithmic limits or virtual orders at key price levels to smooth transitions.

A tiered circuit-breaker system, similar to traditional finance, could enhance resilience:

- Mild Phase: If spreads widen or depth falls below warning thresholds, delay matching for 3–5 seconds and restrict market orders.

- Moderate Phase: If multiple makers withdraw and depth drops below 30% of historical averages, halt trading and issue a public risk notice.

- Severe Phase: Allow exchanges or on-chain governance contracts to temporarily post support bids until new market makers resume operations.

The goal is not to force liquidity providers to stay, but to prevent a total liquidity collapse when they leave.

3. Balancing Efficiency and Risk Control

As token counts surge and narrative lifecycles shorten, traditional high-frequency models can no longer efficiently cover every asset. The challenge is to expand quoting coverage without compromising risk controls.

A promising direction is RFQ 2.0 and intent-based matching. In such systems, users broadcast their trading intent, and market makers or solvers compete to fulfill it, dramatically improving efficiency for long-tail assets. Protocols like CowSwap and UniswapX have already laid the groundwork for this distributed infrastructure.

At the same time, project–market maker relationships must evolve from opaque incentives to transparent cooperation. Many new tokens still depend on token loan + rebate schemes — useful in the short term but vulnerable to manipulation.

Future solutions should use on-chain, contract-based incentive systems, where every loan, quote, and recall is immutably recorded with defined time windows and terms. This would eliminate the “subsidize–pump–dump” pattern and align incentives toward sustainable liquidity.

4. Multi-Dimensional Regulation and Self-Governance

As crypto converges with traditional finance, professionalization and accountability will define the next stage of market making. Regulation should extend beyond manipulation control to include licensing, conduct tracking, and auditable behavior records.

Institutions obtaining a market-making license should:

- Sign accountability clauses and undergo periodic performance reviews.

- Record behavioral metrics — such as cancellation rates, spread anomalies, and circuit-break triggers — on-chain for auditability.

- Face graylisting or suspension for high-risk conduct like abusing rebates or undisclosed self-trading.

In parallel, industry self-regulation must emerge — through market-making associations or alliances standardizing SLAs, disclosure templates, and third-party data audits. Publishing quarterly “Market Maker Performance Rankings” could further enhance accountability.

Only when market making becomes measurable, auditable, and accountable can liquidity evolve from a trust-based service into a regulated market infrastructure.

Conclusion

Over the past decade, crypto liquidity has been upheld by a small circle of algorithmic teams; in the decade ahead, it will be sustained by institutions, data, and trust. The role of market makers is being redefined — no longer as operators of hidden depth, but as co-builders of transparency, stability, and accountability.

When on-chain data makes market-making behavior visible, when circuit breakers enable markets to self-heal, and when disclosure and regulation bind liquidity providers to greater responsibility, crypto will evolve from “flash liquidity” to “institutionalized liquidity.”

At that stage, prices will no longer hinge on isolated trades but be supported by transparent, interconnected liquidity networks — and market makers will cease to be seen as shadowy dealers, becoming instead the trusted operators of the market’s core infrastructure.

About Us

Hotcoin Research, the core research and investment arm of Hotcoin Exchange, is dedicated to turning professional crypto analysis into actionable strategies. Our three-pillar framework — trend analysis, value discovery, and real-time tracking — combines deep research, multi-angle project evaluation, and continuous market monitoring.

Through our Weekly Insights and In-depth Research Reports, we break down market dynamics and spotlight emerging opportunities. With Hotcoin Selects — our exclusive dual-screening process powered by both AI and human expertise — we help identify high-potential assets while minimizing trial-and-error costs.

We also engage with the community through weekly livestreams, decoding market hot topics, and forecasting key trends. Our goal is to empower investors of all levels to navigate cycles with confidence and capture long-term value in Web3.

Risk Disclaimer

The cryptocurrency market is highly volatile, and all investments carry inherent risks. We strongly encourage investors to stay informed, assess risks thoroughly, and follow strict risk management practices to protect their assets.

Connect with Us

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

Email: labs@hotcoin.com

【免责声明】市场有风险,投资需谨慎。本文不构成投资建议,用户应考虑本文中的任何意见、观点或结论是否符合其特定状况。据此投资,责任自负。